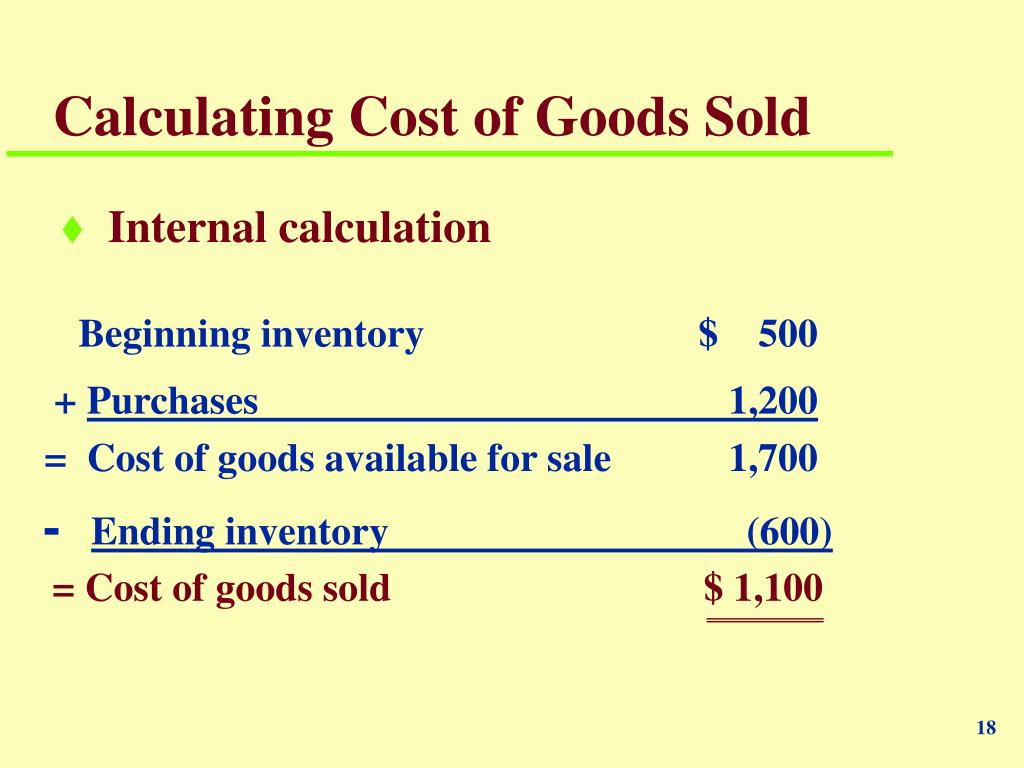

Cost Of Goods Items . the cost of goods sold (cogs) refers to the cost of producing an item or service sold by a company. you can calculate the cost of goods sold in four steps: a thorough understanding of how cost of goods sold (cogs) is calculated, how it differs from sg&a expenses, and its relationship to. It includes material cost, direct labor cost, and. cost of goods sold (cogs) measures the “ direct cost ” incurred in the production of any goods or services. the cost of goods sold (cogs) is an accounting term used to describe the direct expenses incurred by a company. cost of goods sold (cogs) is the direct cost of a product to a distributor, manufacturer, or retailer. cost of goods sold, often abbreviated cogs, is a managerial calculation that measures the direct costs incurred in producing.

from haipernews.com

a thorough understanding of how cost of goods sold (cogs) is calculated, how it differs from sg&a expenses, and its relationship to. cost of goods sold (cogs) measures the “ direct cost ” incurred in the production of any goods or services. the cost of goods sold (cogs) refers to the cost of producing an item or service sold by a company. cost of goods sold, often abbreviated cogs, is a managerial calculation that measures the direct costs incurred in producing. cost of goods sold (cogs) is the direct cost of a product to a distributor, manufacturer, or retailer. the cost of goods sold (cogs) is an accounting term used to describe the direct expenses incurred by a company. It includes material cost, direct labor cost, and. you can calculate the cost of goods sold in four steps:

How To Calculate Cost Of Goods Sold Haiper

Cost Of Goods Items a thorough understanding of how cost of goods sold (cogs) is calculated, how it differs from sg&a expenses, and its relationship to. It includes material cost, direct labor cost, and. you can calculate the cost of goods sold in four steps: cost of goods sold (cogs) measures the “ direct cost ” incurred in the production of any goods or services. a thorough understanding of how cost of goods sold (cogs) is calculated, how it differs from sg&a expenses, and its relationship to. cost of goods sold (cogs) is the direct cost of a product to a distributor, manufacturer, or retailer. the cost of goods sold (cogs) refers to the cost of producing an item or service sold by a company. the cost of goods sold (cogs) is an accounting term used to describe the direct expenses incurred by a company. cost of goods sold, often abbreviated cogs, is a managerial calculation that measures the direct costs incurred in producing.

From www.tickertape.in

Cost of Goods Sold Definition, Calculation, And More Glossary by Cost Of Goods Items cost of goods sold (cogs) is the direct cost of a product to a distributor, manufacturer, or retailer. the cost of goods sold (cogs) is an accounting term used to describe the direct expenses incurred by a company. the cost of goods sold (cogs) refers to the cost of producing an item or service sold by a. Cost Of Goods Items.

From haipernews.com

How To Calculate Cost Of Goods Sold Using Job Order Costing Haiper Cost Of Goods Items you can calculate the cost of goods sold in four steps: a thorough understanding of how cost of goods sold (cogs) is calculated, how it differs from sg&a expenses, and its relationship to. cost of goods sold (cogs) is the direct cost of a product to a distributor, manufacturer, or retailer. the cost of goods sold. Cost Of Goods Items.

From accountingcorner.org

Cost of Goods Sold Formula & Explanation Accounting Corner Cost Of Goods Items It includes material cost, direct labor cost, and. a thorough understanding of how cost of goods sold (cogs) is calculated, how it differs from sg&a expenses, and its relationship to. the cost of goods sold (cogs) refers to the cost of producing an item or service sold by a company. you can calculate the cost of goods. Cost Of Goods Items.

From www.deskera.com

What Is Cost of Goods Sold (COGS)? Definition, Calculation, Examples Cost Of Goods Items you can calculate the cost of goods sold in four steps: cost of goods sold (cogs) is the direct cost of a product to a distributor, manufacturer, or retailer. the cost of goods sold (cogs) refers to the cost of producing an item or service sold by a company. the cost of goods sold (cogs) is. Cost Of Goods Items.

From www.trickyfinance.com

Cost of Goods Sold What else you must know about and how to calculate? Cost Of Goods Items It includes material cost, direct labor cost, and. cost of goods sold, often abbreviated cogs, is a managerial calculation that measures the direct costs incurred in producing. the cost of goods sold (cogs) refers to the cost of producing an item or service sold by a company. a thorough understanding of how cost of goods sold (cogs). Cost Of Goods Items.

From www.whitehutchinson.com

Do you know your cost of goods sold percentage? Leisure eNewsletter Cost Of Goods Items you can calculate the cost of goods sold in four steps: the cost of goods sold (cogs) is an accounting term used to describe the direct expenses incurred by a company. cost of goods sold (cogs) measures the “ direct cost ” incurred in the production of any goods or services. cost of goods sold (cogs). Cost Of Goods Items.

From mint.intuit.com

Calculate Cost of Goods Sold StepbyStep Guide MintLife Blog Cost Of Goods Items a thorough understanding of how cost of goods sold (cogs) is calculated, how it differs from sg&a expenses, and its relationship to. the cost of goods sold (cogs) refers to the cost of producing an item or service sold by a company. the cost of goods sold (cogs) is an accounting term used to describe the direct. Cost Of Goods Items.

From www.educba.com

Cost of Goods Manufactured Formula Examples with Excel Template Cost Of Goods Items cost of goods sold (cogs) measures the “ direct cost ” incurred in the production of any goods or services. you can calculate the cost of goods sold in four steps: It includes material cost, direct labor cost, and. cost of goods sold, often abbreviated cogs, is a managerial calculation that measures the direct costs incurred in. Cost Of Goods Items.

From www.financestrategists.com

Cost of Goods Sold (COGS) Definition and Accounting Methods Cost Of Goods Items the cost of goods sold (cogs) is an accounting term used to describe the direct expenses incurred by a company. you can calculate the cost of goods sold in four steps: the cost of goods sold (cogs) refers to the cost of producing an item or service sold by a company. cost of goods sold (cogs). Cost Of Goods Items.

From www.wizeprep.com

Finished Goods and Cost of Goods Sold Wize University Managerial Cost Of Goods Items a thorough understanding of how cost of goods sold (cogs) is calculated, how it differs from sg&a expenses, and its relationship to. the cost of goods sold (cogs) refers to the cost of producing an item or service sold by a company. It includes material cost, direct labor cost, and. you can calculate the cost of goods. Cost Of Goods Items.

From www.inflowinventory.com

Calculate Your Cost of Goods Manufactured With This Formula Cost Of Goods Items the cost of goods sold (cogs) is an accounting term used to describe the direct expenses incurred by a company. cost of goods sold (cogs) measures the “ direct cost ” incurred in the production of any goods or services. a thorough understanding of how cost of goods sold (cogs) is calculated, how it differs from sg&a. Cost Of Goods Items.

From www.financestrategists.com

Cost of Goods Manufactured Statement Calculation & Example Cost Of Goods Items the cost of goods sold (cogs) is an accounting term used to describe the direct expenses incurred by a company. cost of goods sold (cogs) is the direct cost of a product to a distributor, manufacturer, or retailer. the cost of goods sold (cogs) refers to the cost of producing an item or service sold by a. Cost Of Goods Items.

From www.technewsera.com

cost of goods sold formula cost of goods sold formula Cost Of Goods Items It includes material cost, direct labor cost, and. the cost of goods sold (cogs) is an accounting term used to describe the direct expenses incurred by a company. you can calculate the cost of goods sold in four steps: cost of goods sold (cogs) measures the “ direct cost ” incurred in the production of any goods. Cost Of Goods Items.

From www.youtube.com

How to compute the cost of goods sold YouTube Cost Of Goods Items cost of goods sold (cogs) measures the “ direct cost ” incurred in the production of any goods or services. It includes material cost, direct labor cost, and. the cost of goods sold (cogs) refers to the cost of producing an item or service sold by a company. a thorough understanding of how cost of goods sold. Cost Of Goods Items.

From efinancemanagement.com

Cost of Goods Sold (COGS) All You Need To Know Cost Of Goods Items cost of goods sold (cogs) is the direct cost of a product to a distributor, manufacturer, or retailer. It includes material cost, direct labor cost, and. you can calculate the cost of goods sold in four steps: the cost of goods sold (cogs) refers to the cost of producing an item or service sold by a company.. Cost Of Goods Items.

From stockanalysis.com

Cost of Goods Sold (COGS) Meaning, Formula, and How to Calculate Cost Of Goods Items cost of goods sold (cogs) measures the “ direct cost ” incurred in the production of any goods or services. the cost of goods sold (cogs) is an accounting term used to describe the direct expenses incurred by a company. It includes material cost, direct labor cost, and. cost of goods sold (cogs) is the direct cost. Cost Of Goods Items.

From accountingcorner.org

Cost of goods manufactured Accounting Corner Cost Of Goods Items cost of goods sold, often abbreviated cogs, is a managerial calculation that measures the direct costs incurred in producing. you can calculate the cost of goods sold in four steps: cost of goods sold (cogs) measures the “ direct cost ” incurred in the production of any goods or services. cost of goods sold (cogs) is. Cost Of Goods Items.

From www.accountancyknowledge.com

Cost of Goods Sold Examples CGS Format Solved Problems Cost Of Goods Items the cost of goods sold (cogs) refers to the cost of producing an item or service sold by a company. the cost of goods sold (cogs) is an accounting term used to describe the direct expenses incurred by a company. cost of goods sold (cogs) is the direct cost of a product to a distributor, manufacturer, or. Cost Of Goods Items.